Jeb Bush Campaign Press Release - Backgrounder: Jeb Bush's Tax Reform Plan: The Reform and Growth Act of 2017

Overview:

Barack Obama's policies have given us an anemic economy, where most Americans are falling behind. The share of Americans working or looking for work is at a 38-year low. More than 6 million people are working part-time jobs when they'd prefer full-time. Roughly 5.5 million more Americans are living in poverty than when President Obama came to office.

As the next president of the United States, Jeb Bush has a plan to take on our biggest problems and introduce pro-growth policies to accelerate growth to 4 percent and foster the creation of 19 million new jobs. He can do it, because he's done it in Florida. Thanks to pro-growth policies led by $19 billion in tax cuts, Florida's economy took off and the state ended up leading the nation in small business creation. 81,000 new small businesses created a state economy that produced 1.3 million new jobs, the most in the nation from 2000-2007. Florida averaged 4.4 percent growth during his time in office; the unemployment rate fell to 3.5 percent and middle class incomes increased by $1,300.

Restoring the right to rise in America requires accelerating growth, and that can't be done without real tax reform. A key element of Jeb Bush's economic agenda is a complete overhaul of the U.S. tax code. Fundamental changes in tax policy are among the most promising policy changes to move people back to work, increase productivity and raise their wages. Few policy changes would have a more transformational effect on economic activity, income and employment than real tax reform. The nation needs a tax system that is simpler, fairer and can jumpstart economic growth.

Restoring the right to rise in America requires accelerating growth, and that can't be done without real tax reform.

That is why, as President, Jeb Bush will submit to Congress and sign into law the Reform and Growth Act of 2017.

The Current Broken Tax Code

The convoluted and contradictory nature of the U.S. tax code demands reform. It has been almost 30 years since we overhauled the tax code. During that time, special loopholes and deductions have skyrocketed, tax rates have risen and the tax code has become even more complex. The failures of the tax code are too numerous to fully list, but consider:

Under this administration taxes have risen for small businesses and investors. When President Obama entered office, the highest income tax rate on small businesses was 35 percent, today it is more than 10 percent higher. Taxes on investments — the driver of U.S. productivity — have risen from 15 percent to 23.8 percent. Meanwhile, the President's job-destroying health care law increased taxes on low- and middle-income Americans. The President's tax increases have increased tax revenue to levels far above historical norms.

The U.S. has the highest statutory corporate tax rate in the developed world. The tax rate is 60 percent higher than China's top rate. This high statutory rate discourages foreign investment in the U.S. And the huge number of special preferences and loopholes means the corporate tax code not only harms economic activity, but also collects much less revenue than advertised. While acknowledging the need for corporate tax reform, the President has refused to lead. As other nations have reformed their corporate taxes, the United States has become even less competitive. We now regularly see U.S. firms re-domiciling their businesses outside of the U.S., including the large number of so-called corporate inversions.

The tax code's deductions, credits, and exclusions mean similarly situated taxpayers may have vastly different tax liabilities. These tax expenditures require higher marginal tax rates and distort economic behavior. The state and local tax deduction subsidizes high-tax states. Deductibility of interest for businesses subsidizes debt, discouraging equity financing, thereby threatening long-run prosperity.

The mind-numbing complexity of the U.S. tax code wastes billions of dollars. The cost of complying with the U.S. tax code is at least $168 billion.[1] Families spend an average of eight hours filing their taxes. Businesses spend an average of 24 hours complying with complicated tax rules and depreciation schedules with larger businesses spending considerable more time complying.[2] Further, millions of Americans are excluded from filing a basic return because of age, family status, or income.[3]

Jeb's Plan: The Reform and Growth Act of 2017:

Fundamental tax reform requires overhauling the U.S. Tax Code. Jeb Bush's Reform and Growth tax plan will eliminate special-interest deductions and lower tax rates to help create 19 million new jobs and rising middle-class wages.

Jeb's tax reform plan centers on accomplishing these major goals:

- Lower marginal tax rates.

- Simplify the tax code for all Americans to lessen the power of the IRS and increase both prosperity and fairness.

- Reduce loopholes and special tax provisions created by lobbyists that invariably benefit those at the top.

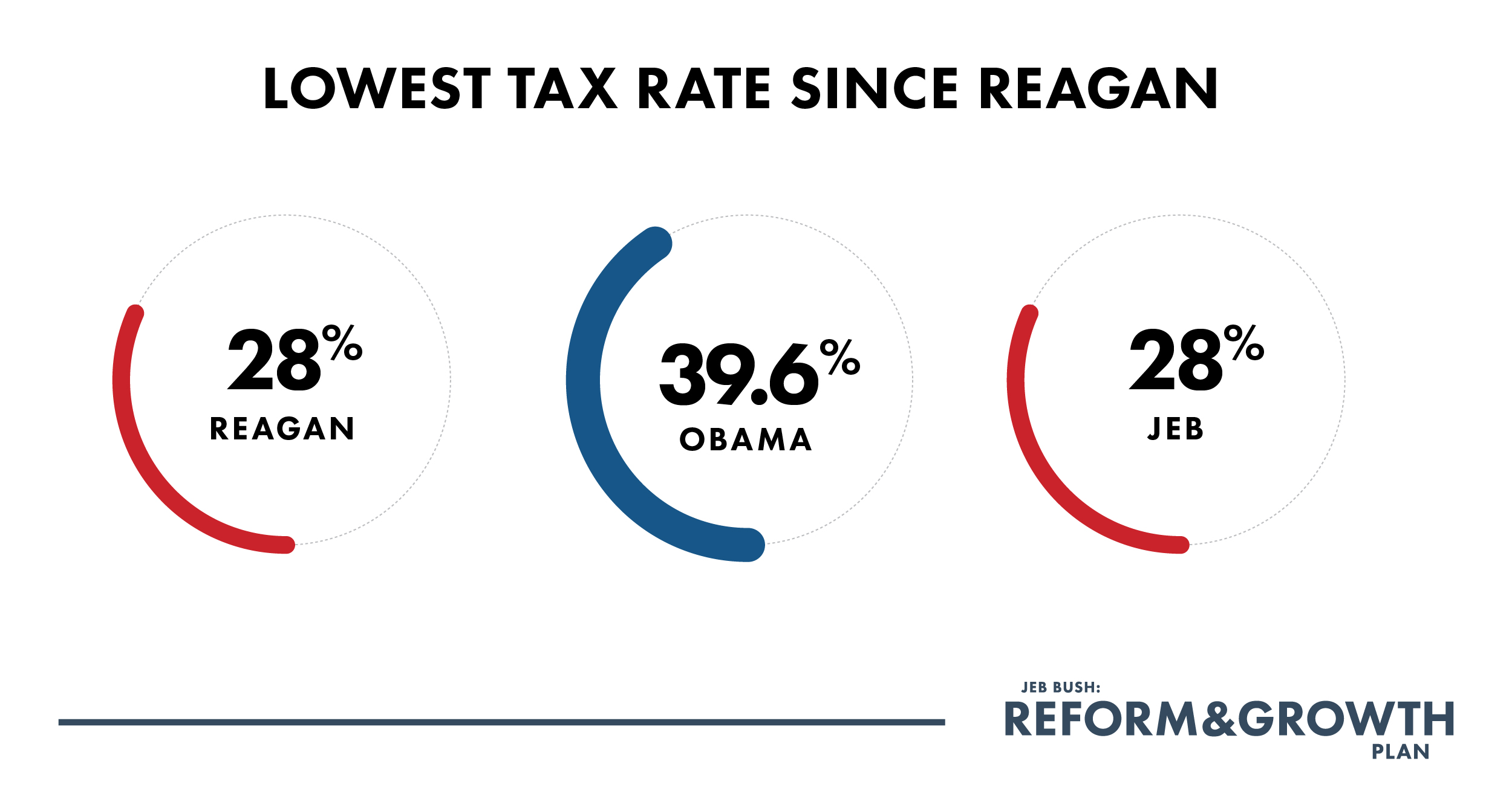

- Replace the current broken tax code — which has seven different tax rates, with a top rate of nearly 40 percent — with a streamlined system with only three rates: 28 percent, 25 percent and 10 percent.

- Reform our business tax code to ensure U.S. businesses, small and large, can be at the forefront for the competitive 21st century global economy.

- Lower our corporate tax rate to 20 percent — below China's — to bring jobs and manufacturing back to the United States.

- Ensure that Americans who are able and willing to work are incentivized to rejoin the workforce.

Taxes on Individuals and Families

| Current Policy | Jeb's Plan | |

| Tax Rates | Seven tax brackets: 10%, 15%, 25%, 28%,33%, 35%, 39.6% |

Three tax brackets: 10%, 25%, 28% |

| Personal Exemption | $4,000 | $4,000 |

| Standard Deduction | $12,600 for married filers | $22,600 for married filers |

| $6,300 for single filers | $11,300 for single filers | |

| Itemized Deductions | ||

| State and Local Tax Deduction | No Limit | Eliminated |

| Charitable Contributions Deduction | Capped at 50 percent of AGI | No Change |

| Mortgage Interest Rate Deduction | Limited to interest on first $1 million of debt | Cap the tax value of deductions at 2 percent of AGI |

| Other Itemized Deductions | Medical deduction, Casualty, Miscellaneous, etc. | |

| Personal Exemption Phase-out (PEP) | Personal exemption and itemized deductions phased-out for upper middle class incomes | Phase-outs eliminated |

| Itemized Deduction Phase-out (Pease) | ||

| Personal AMT | Filers must determine tax liability under two sets of tax rules | Eliminated |

Rates and Brackets

The proposal reduces the number of tax brackets from seven to three. The three remaining rates are 10, 25, and 28 percent. The standard deduction would be increased by $5,000 for individuals and $10,000 for joint filers. Under the proposal no one will receive a marginal rate increase.

| Tax Schedules under Jeb's Plan (2015 levels) | ||

| Rates | Single Filer | Married Filer |

| Standard Deduction | $0 to $11,300 | $0 to $22,600 |

| 10% | $11,301 to $43,750 | $22,601 to $87,500 |

| 25% | $43,751 to $97,750 | $87,501 to $163,800 |

| 28% | $97,751 and above | $163,801 and above |

Single filers with incomes below $15,300 and married couples with two children with incomes below $38,600 would no longer pay income taxes. All non-itemizing filers above these thresholds would receive tax reduction of at least $500 for single filers and at least $1,000 for married filers.

The majority of tax filers would see a marginal rate reduction. The rate reductions will result in lower tax liabilities for all non-itemizing tax filers, many of whom tend to be lower income or in retirement.

Loopholes and Deductions

Today, the tax code is a labyrinth littered with thousands of special-interest giveaways, subsidies and other breaks written to favor Washington insiders. The code is rigged with multiple carve-outs for favored industries. It penalizes people for moving up the economic ladder.

Itemizing deductions leads to more complicated tax returns, requiring more time and effort to file. These deductions often result in taxpayers with similar incomes incurring dramatically different tax liabilities.

By expanding the standard deduction and limiting deductions, the proposal will reduce the need for itemization. In the aggregate, the proposal would reduce the number of itemizers by almost 80 percent (from 47 million to 13 million). This reform will simplify taxes dramatically for these 34 million taxpayers.

The proposal eliminates the state and local tax deduction. The tax deduction favors filers in states with high tax rates. Over 90 percent of tax expenditures related to state and local taxes accrue to filers with AGIs above $100,000.[4] The tax expenditure subsidizes high tax states, which encourages poor fiscal policy by state governments. High tax, high spending states have the right to conduct whatever fiscal policies they prefer, but citizens of lower tax states should not be required to pay for it.

All remaining itemized deductions, with the exception of charitable contributions, would be limited by a tax cap. The cap would limit the tax value of itemized deductions to two percent of a filer's adjusted gross income. Since it is dependent on a progressive tax schedule, a filer in a lower bracket will be able to have more deductions as a share of their incomes. Low- and middle- income filers in the 10 percent tax bracket could deduct up to 20 percent of their income, while high-income filers in the top bracket could only deduct about 7 percent. The cap has the virtue of allowing the taxpayer to use any of these deductions but not to an excessive extent.

Impact on Taxpayers

All non-itemizing tax filers will see a tax reduction under the income tax reforms. Low-income taxpayers will receive the biggest percentage reduction in the taxes.

| Impact of Tax Plan | ||||

| Taxpayer Type | Adjusted Gross Income | Tax Liability Change | Percent Reduction in Taxes | Percent Change in After-Tax Income |

| Single No Dependents | $15,300 | $500 | 100% | 3.2% |

| $25,000 | $774 | 45.4% | 3.3% | |

| $50,000 | $1,911 | 33.4% | 4.3% | |

| $100,000 | $1,911 | 10.5% | 2.3% | |

| $250,000 | $4,431 | 7.1% | 2.4% | |

| Married Two Dependents | $38,600 | $1,000 | 100% | 2.6% |

| $50,000 | $1,148 | 50.2% | 2.4% | |

| $75,000 | $2,398 | 39.7% | 3.5% | |

| $100,000 | $3,648 | 37.3% | 4.0% | |

| $125,000 | $3,823 | 24.4% | 3.5% | |

| $250,000 | $3,823 | 7.8% | 1.9% | |

| Note: Change in tax liability is shown for filers who do not currently itemize. | ||||

Business and Investment Taxes

| Current Policy | Jeb's Plan | |

| Business Taxes | ||

| Top Corporate Tax Rate | 35% | 20% |

| Top Pass-Through Rate | 39.6% | 28% |

| Foreign earnings | World-wide taxation | Up to 8.75% deemed repatriation tax on prior foreign earnings |

| Investments | Complicated depreciation schedules | Full expensing for new investments |

| Interest Paid | Deductible | Not deductible(non-financial institutions) |

| Interest Received | Taxable at Ordinary Rates | 20% |

| Corporate AMT | Filers must determine tax liability under two sets of tax rules | Eliminated |

| Investment Taxes | ||

| Top Capital Gains Rate | 23.8% | 20% |

| Top Dividends Rate | 23.8% | 20% |

| Interest Received | Taxable at Ordinary Rates | 20% |

Lowering Corporate Tax Rates

The top corporate tax rate would be reduced to 20 percent. The rate would be lower than the OECD average and below China's corporate tax rate. The tax rate would be tied with the 8th lowest among developed nations. While the statutory corporate income tax rate is important to certain decisions such as where to locate profits and deductions, marginal investment will benefit greatly from expensing benefit and generally face a zero tax rate at the margin but for the 20 percent tax on individual investor returns.

Ending Penalties on Capital Investment

Under the current tax base, businesses may only deduct a portion of their capital expenditures. This system requires complicated depreciation schedules that increase compliance costs for businesses. The current depreciation schedules distort business investment by providing different tax rates for different business assets.

Under the proposal, businesses could fully expense all new capital investments, an approach that seeks to remove taxes on marginal investment returns. This would simplify the tax code and significantly increase incentives to invest in new machines, equipment, buildings, and other structures.

Treatment of Interest

Generally, businesses would no longer be able to deduct interest payments. Under the current code, debt financing receives favorable tax treatment relative to equity financing. Allowing both expensing and interest deductions would create negative tax rates on debt financed capital expenditures.

S-Corps, LLCs, and partnerships would continue to pay taxes under the personal income tax code. The highest tax rate pass-throughs would face would be the top individual marginal tax rate of 28 percent. While it might appear that pass-throughs are treated unfairly compared to the lower rate for C-Corps, shareholders of C-Corps would still be required to pay capital gains and dividend taxes at a top rate of 20 percent. The effective tax rate on C-Corp owners would still exceed those of pass-throughs.

Ending World-Wide Taxation

The current system of world taxation deters American firms from repatriating foreign earnings and discourages firms from headquartering or managing their capital in the United States. The United States is one of seven OECD countries to tax businesses on all profits independent of where their profits were earned.[5]

Under the proposal, firms would only pay taxes on profits earned in the United States. As part of the transition away from worldwide taxation, firms with deferred foreign income would face a deemed repatriation tax of up to 8.75 percent. Firms would have ten years to pay the tax.

Loopholes and Deductions

Most business tax expenditures are related to the deferral of foreign earnings and accelerated depreciation policies. Because the proposal would adopt territorial taxation and full expensing, these special tax expenditures would no longer exist, rather all companies would have equal tax treatment. Several remaining tax expenditures for businesses would be phased out. Importantly, the proposal will maintain the Research and Experimentation Tax Credit. Government has a role in encouraging basic research and the R&E Tax Credit furthers this end.

Investment Income

The proposal would eliminate Obamacare's 3.8 percent net investment tax. The tax is currently levied on single filers with AGIs above $200,000 and married filers with AGIs above $250,000. Obamacare's investment tax resulted in a top capital gains and dividend tax rate of 23.8 percent. This discourages capital investments that increase productivity and ultimately increase wages.

All non-investment income will be taxed at ordinary rates. That is, only those putting real capital at risk will be able to benefit from the lower rate on capital gains. Specifically, "carried interest" without real capital at risk will no longer receive the same tax treatment as real investment income, but instead will face a top rate of 28 percent.

Tax Code Simplification

Full expensing will bring dramatic tax simplification for businesses. Meanwhile, limiting deductions while reducing rates will simplify the tax code and decision-making for individuals and families. As mentioned above, the number of itemizers would fall from 47 million to 13 million. There are several other parts of the tax code that needlessly complicate tax filing. Jeb's plan will simplify them.

Eliminating the Alternative Minimum Tax

The reform would eliminate the alternative minimum tax (AMT) for individuals and corporations. The AMT requires filers to determine their tax liability under two separate tax systems. It was intended to tax only a handful of Americans, but over time it has become a burden on middle class families. By eliminating the AMT, the proposal simplifies the tax code and ensures filers will no longer be forced to calculate their tax liability under two different tax systems.

Eliminating the Personal Exemption Phase-Out and Limit on Itemized Deductions

The proposal eliminates the personal exemption phase-out (PEP) and the limit on itemized deductions for high-income taxpayers (Pease). Eliminating PEP and Pease not only reduces the complexity of the tax code, it also reduces the marginal tax rate for affected filers.

Eliminating the Estate Tax

Death should not be taxable event. This reform ends the estate and gift tax to protect family businesses and farms from an unfair tax. The proposal will eliminate the "step-up basis" upon death for capital gains in excess of the current estate tax thresholds. When the gains from these estates are eventually realized, heirs will pay capital gains based on the original basis (so-called "carryover basis"). The tax treatment for bequests to spouses would be unchanged to current law.

Getting America Back to Work

The reduction in personal income taxes and business taxes will increase productivity, hiring, and encourage more Americans to return to work. There are, however, certain groups that may still face relatively high marginal tax rates that discourage labor force participation. The proposal suggests further reducing taxes for low-income childless filers, secondary earners, and seniors.

Earned Income Tax Credit Expansion

The Earned Income Tax Credit provides subsidies to low-income tax filers. Up to certain income thresholds, the credit increases with earnings. For example, a single filer with one child receives $0.34 for every dollar earned up to approximately $10,000. At that point the credit plateaus. Currently, the EITC is not available to childless filers below age 25 and the benefit for childless filers ages 25 to 64 is capped at $503.

This reform will double the size of the credit for childless workers. This change means childless workers face a zero marginal tax rate when entering the workforce. The proposal would also expand the credit to filers ages 21 to 24 who are not enrolled full time in school and double the size of the maximum credit. There are approximately 1.6 million childless filers between the ages of 21 and 24 not in the work force who would be eligible for the expanded credit.[6] The credit will also be reformed to reduce fraud rates.

Allowing Secondary Earners to File Taxes Separately

Under the current tax system, married filers are permitted to file separately. However, doing so limits the credits either spouse may claim and often results in higher tax liability. By discouraging spouses from filing separately, secondary earners face high marginal tax rate as their income is added to the primary earners income. This discourages secondary earners from entering the work force.

In 2013, there were 14.2 million married families where only one spouse worked.[7]

The proposal would allow the individual in a married couple with the lower earnings (wage and salary income) to file a separate simple tax return using the tax schedule for single filers. All other income, deductions, and credits would remain on the tax return of the primary earner. This would achieve four goals:

- Eliminates the marriage penalty.

- Provides the current non-working spouse with a zero marginal income tax rate on the first dollar of earnings and reduce rates on additional earnings.

- Lowers the marginal tax rate for many second earners.

- Lowers the marginal tax rate for many primary earners.

Payroll tax relief for seniors

Nearly all workers must contribute 6.2 percent of their income (up to specified levels) for the employee share of Social Security taxes. Currently, seniors who are eligible for Social Security must continue to pay payroll taxes so long as they remain in the work force. This proposal eliminates the employee portion of payroll taxes for workers who have reached the full retirement age.

[1] National Taxpayer Advocate (2012), 2012 Annual Report to Congress, Volume 1. available at http://www.taxpayeradvocate.irs.gov/2012-Annual-Report/FY-2012-Annual-Re...

[2] IRS, Estimates of Taxpayer Burden, available at http://www.irs.gov/instructions/i1040a/ar03.html

[3] The IRS allows childless filers under 65 with taxable income below $100,000 to file a 1040EZ. Other filers must file more complicated 1040 forms. IRS, "1040EZ", available at http://www.irs.gov/pub/irs-prior/f1040ez—2014.pdf

[4] Joint Committee on Taxation (2014). Estimates of Federal Tax Expenditures For Fiscal Years 2014-2018.

[5] Since 2000, ten OECD countries have transitioned away from world-wide taxation. Tax Foundation, Available at hhttp://taxfoundation.org/article/global-perspective-territorial-taxation

[6] Data derived from U.S. Census Bureau, Current Population Survey, March Supplement, 2014.

[7] Data derived from U.S. Census Bureau, Current Population Survey, March Supplement, 2014.

Related Images

Jeb Bush, Jeb Bush Campaign Press Release - Backgrounder: Jeb Bush's Tax Reform Plan: The Reform and Growth Act of 2017 Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/312095