Some days ago you wrote me that there was a proposal before your committee to amend the Public Debt Bill by adding a provision nullifying the Executive Order issued by me under the Act of October 2, 1942, limiting salaries to $25,000 after taxes, and asked if I cared to submit any views with reference to the proposal. In reply I told you that I hoped the Public Debt Bill could be passed without adding amendments not related to the subject, but that if the committee thought otherwise I would later write you my views.

In a message to the Congress on April 27, 1942, I stated:

"Discrepancies between low personal incomes and very high personal incomes should be lessened; and I therefore believe that in time of this grave national danger, when all excess income should go to win the war, no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year."

Thereafter the Treasury advised the committee:

"To implement the President's proposal, the Treasury now recommends the enactment of a 100 percent war supertax on that part of the net income after regular income tax which exceeds a personal exemption of $25,000 . . . .It is recommended that for the purpose of the supertax, joint returns be made mandatory and that a personal exemption of $25,000 for each spouse be allowed, or in effect $50,000 for the married couple."

So far as I know, neither house of the Congress acted upon the recommendation.

When the Act of October 2, 1942, was passed, it authorized me to adjust wages or salaries whenever I found it necessary "to correct gross inequities and also aid in the effective prosecution of the war." Pursuant to this authority, I issued an Executive Order in which, among other things, it was provided that in order to correct gross inequities and to provide for greater equality in contributing to the war effort no salary should be authorized to the extent that it exceeds $25,000 net after the payment of taxes. Provision was made for certain allowances in order to prevent undue hardships.

The legality of the Executive Order was attested by the Attorney General prior to its issuance. No Executive Order is issued without such approval.

The regulation issued under this Order with my approval was so worded that it affected only gross salaries in excess of $67,200, the amount of taxes due upon such salaries reducing them to approximately $25,000 net. I could not exercise the discretion vested in me by the Congress to adjust salaries without finding that it is a gross inequity in wartime to permit one man to receive a salary in excess of $67,200 a year while the Government is drafting another man and requiring him to serve with the armed forces for $600 per year.

I believed it a gross inequity for the president of a corporation engaged in the production of materials for the Government to receive a salary and bonus of $500,000 a year while the workers in the corporation were denied an increase in wages under the provisions of the law and my Executive Order. The correction of such inequities, I believed, would aid in the effective prosecution of the war.

I call your attention to the fact that the limitation of salaries was, by the language of the Order, limited to the war period, and that the law upon which the Order was based expires June 30,1944, and can be continued only by the affirmative action of the Congress. Therefore no fair argument can be made that the limitation was intended either by the Congress or by the Executive to become permanent law. The intention was made plain in my original Message. I then and there affirmed my belief that this limitation should be made "in time of this grave national danger when all excess income should go to win the war."

This desire to limit personal profits during wartime is no new thought. Its origin is neither alien nor obscure. It is in accord with the solemn pledges of the Republican Party and the Democratic Party.

In 1924, just after our soldiers had returned from the first World War and the leaders of both parties were conscious of the views of the returning soldiers as to war profiteering, the Republican Party declared in its platform:

"We believe that in time of war the Nation should draft for its defense not only its citizens but also every resource which may contribute to success. The country demands that should the United States ever again be called upon to defend itself by arms the President be empowered to draft such material resources and such services as may be required and to stabilize the prices of services and essential commodities, whether utilized in actual warfare or private activity."

The Democratic Party platform the same year solemnly pledged:

"In the event of war in which the manpower of the Nation is drafted, all other resources should likewise be drafted. This will tend to discourage war by depriving it of its profits."

I repeat, this was in 1924, not 1928, and that these were the platforms of the Republican and Democratic Parties.

I agree with those who say that the limitation of salaries does not deal adequately with the problem of excessive personal profits and that the limitation should extend to all income. My Executive Order endeavored to correct the inequity to the extent of the power granted me. The Congress can, however, make the limitation adequate by extending it to the coupon clipper as well as the man who earns the salary.

Therefore, I urge the Congress to levy a special war supertax on net income from whatever source derived (including income from tax-exempt securities), which, after payment of regular income taxes, exceeds $25,000 in the case of a single person and $50,000 in the case of a married couple.

If the Congress does not approve the recommendation submitted by the Treasury last June that a flat 100 percent supertax be imposed on such excess incomes, then I hope the Congress will provide a minimum tax of 50 percent, with steeply graduated rates as high as 90 percent. The exact amount of the exemptions to be allowed and the exact rate of taxation to be applied are necessarily arbitrary, and these are matters the Congress must decide.

If taxes are levied which substantially accomplish the purpose I have indicated, either in a separate bill or in the general revenue bill you are considering, I shall immediately rescind the section of the Executive Order in question. The Congress may appropriately provide that such taxes should take the place of the $25,000 limitation imposed by Executive Order.

I trust, however, that without such tax levies the Congress will not rescind the limitation and permit the existence of inequities that seriously affect the morale of soldiers and sailors, farmers and workers, imperiling efforts to stabilize wages and prices, and thereby impairing the effective prosecution of the war.

Hon. Robert Doughton, Chairman, House Ways and Means Committee

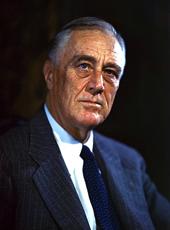

Franklin D. Roosevelt, Letter to the House Ways and Means Committee on Salary Limitation. Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/209776