My dear Senator:

In the discussion of the proposed farm bill now pending before the Senate I notice by the Record that you asked the following question of Senator Smith:

It has been generally asserted that the amount available. under the Soil Conservation Act was $500,000,000, subject to a possible contingent additional sum of $125,000,000, making $625,000,000. Is that practically an accurate statement of the present financial situation?Senator Smith replied that your statement of the financial situation is correct.

In this connection I should like to call your attention to the fact that while the amount of $625,000,000 has been appropriated for agricultural programs not all of this sum has been provided for in the present tax structure. You will recall that in my message of March 3, 1936, I recommended additional permanent taxes of $620,000,000, of which $500,000,000 represented a substitution for processing taxes lost as a result of the Supreme Court decision and $220,000,000 was to provide funds for the payment of the veterans' adjusted service bonds. This recommendation resulted in the enactment of the Revenue Act of 2936, which provided the additional revenue requested. The $500,000,000 thus provided for agricultural programs is the only amount now in the tax structure for these purposes.

I assume that the contingent additional sum of $125,000,000 referred to by you is the permanent indefinite appropriation of an amount equal to thirty per centum of the gross receipts from customs duties collected during the preceding calendar year, for the purpose of encouraging exportation and domestic consumption of agricultural commodities by section 32 of the act of August 24, 1935, amending the Agricultural Adjustment Act. It should be apparent that this appropriation has added a burden of expenditure to the Budget without any provision for additional revenues to meet it.

There is, of course, included in the tax base an amount for the normal operating activities of the Department of Agriculture prior to the emergency, which amounted to about $70,000,000 a year, and are separate from the agricultural programs adopted within the past four years. These operating activities, however, have been greatly expanded within recent years without any increase in the revenues to meet the expenditures caused by such expansion. For example, the Soil Conservation Service was added two years ago and now expends more than $25,000,000 a year to control soil erosion; and the Farm Tenancy Act authorizes an appropriation of $20,000,000 for the current fiscal year, $45,000,000 for the next fiscal year, and $70,000,000 annually thereafter.

It is obvious that a constant increase of expenditures without an equally constant increase in revenue can only result in a continuation of deficits. We cannot hope to continue on a sound basis of financial management of Government affairs unless the regular annual expenditures are brought within the revenues. I feel that every effort should be made to keep the new farm program within the present limit of $500,000,000 per annum. If this is not possible I then urge that steps be taken to provide the necessary increase in revenue to meet any expenditures under the new farm program in excess of this sum.

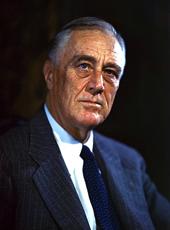

Sincerely yours,

Honorable Alben W. Barkley,

United States Senate.

Franklin D. Roosevelt, Letter on the Proposed Farm Legislation. Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/209026