Statement of Administration Policy: [H.R. 5241] - Department of the Treasury, Postal Service, and General Government Appropriations Bill, FY 1991

(House Rules)

(Sponsors: Whitten (D), Mississippi: Roybal (D), California)

The Administration continues to oppose Congressional action on appropriations bills in advance of a budget summit agreement. Such action could unnecessarily and perhaps harmfully complicate implementation of a final budget resolution that reflects the agreement. However, inasmuch as the House is apparently going to take action, the Administration will express its views on these bills as they come before Congress. The purpose of this letter is to express views on the Department of the Treasury, Postal Service, and General Government Appropriations Bill, FY 1991, as reported by the Committee.

It is the Administration's understanding that the Rules Committee is considering a rule that would waive points of order against several unauthorized programs that are funded in the bill including the U.S. Customs Service, the U.S. Mint, and the Federal Election Commission. In addition, the Office of Information and Regulatory Affairs (OIRA), within the Office of Management and Budget (OMB), is unauthorized and funded in the Committee bill. The Administration would support an amendment to the rule to provide OIRA with the same waiver provided these other programs.

It is the Administration's understanding that in the absence of such a waiver, a point of order may be raised on the floor to strike OMB funding in part or in whole in order to eliminate fupding for OIRA. The Administration is currently engaged in negotiations with the authorizing committee, and, therefore, it would not be appropriate to eliminate funding for OIRA at this time. Should the House pass the bill without OMB/OIRA funding, the President's senior advisors would have no alternative but to recommend a veto of this bill. The House is urged not to allow such an action to affect adversely an otherwise generally acceptable bill.

The Administration supports the overall funding level in this bill as reported by the Committee but has concerns about about several specific provisions in the bill.

The Committee has included a provision that the Administration believes is a "gimmick" designed to reduce FY 1991 outlays. This provision would prohibit the Internal Revenue Service (IRS) from obligating any funds for its critical Tax System Modernization program until the last day of the fiscal year. If the bill were enacted with this provision, it would effectively delay development of crucial upgrades to our tax processing capability for six to twelve months. It would require layoffs of roughly 863 highly skilled systems personnel working on this project. Furthermore, the provision would raise program costs and defer higher revenue yields, staff savings, and taxpayer service improvements expected from this program. The House is urged to delete this provision.

The Administration opposes provisions in the bill amending 18 USC 3056 to expand the authority of the U.S. Secret Service to investigate financial institution fraud. The Senate recently authorized significant additional resources for the Federal Bureau of Investigation (FBI) and other law enforcement entities to combat such fraud. In light of the Senate's action, this new Secret Service authority is unnecessary, and excessive in scope of jurisdiction. The FBI, which currently has primary investigative authority in this area, has the necessary and proven expertise to handle these investigations. A substitute provision that would permit the Department of Justice to utilize personnel from the U.S. Secret Service and other Federal agencies in the investigation arid prosecution of financial institution fraud could be supported by the Administration.

The President's Budget requested a 3.5 percent pay increase for Federal civilian employees, effective January 1, 1991. However, section 618 of the Committee bill provides for a 4.1 percent pay increase. At a time of fiscal constraint, the Administration believes that such an increase is inadvisable.

These and other Administration concerns about this bill are ourxined in the attachment.

Attachment

(House Rules)

DEPARTMENT OF THE TREASURY, POSTAL SERVICE, AND GENERAL GOVERNMENT APPROPRIATIONS BILL, FY 1991

I - MAJOR PROVISIONS SUPPORTED BY THE ADMINISTRATION

The Administration appreciates the Committee's full funding of the Presidents request for the Executive Office of the President.

II. MAJOR PROVISIONS OPPOSED BY THE ADMINISTRATION

A. Funding Levels

Department of the Treasury:

Internal Revenue Service. Recognizing that information systems are investments requiring long-term development, the President's Budget included appropriations language making budget authority for Tax System Modernization ($248 million) available until expended. The House Committee bill fully funds the request but prohibits any obligation of these funds prior to September 30, 1991.

The Administration strongly opposes this provision. Tax System Modernization (TSM) is a major Presidential initiative which will define the tax administration environment for the following decade. It involves major procurements of hardware, software, and contracted services. TSM development is proceeding rapidly along a critical path. Delays until the end of FY 1991 in major procurements would increase development time, thereby increasing the risk of current system breakdown.

In addition to the investment in hardware, software, and labor services furnished by contractors, this initiative also funds the IRS' own ADP specialists and managers involved in the direct oversight of and participation in TSM development. Under this provision, all 863 FTE currently working in Tax System Modernization would have to be let go through a reduction-inforce. The Administration urges the House to support the President's Budget request for this important initiative.

U.S. Customs Service — Salaries and Expenses. By providing $20 million (300 FTE) above the President's request for the U.S. Customs Service, Salaries and expenses account, the Committee bill fails to acknowledge the savings that have justified more than $500 million in investments to date in labor-saving processing and targeting technology (ACS, TECS, IBIS, etc.). These systems were designed to reduce staffing needs without slowing cargo and passenger clearance times or curtailing enforcement efforts. Continued investment in these programs cannot be defended if anticipated savings do not materialize.

U.S. Customs Service — Aerostat Program. The Administration opposes using Department of Defense funds to operate the U.S. Customs Service aerostat program. Since the U.S. Customs Service has had operating responsibility for this program, defense funds should not be used to pay for a domestic discretionary program.

U.S. Postal Service:

Revenue Foregone. Adoption of the Postal Rate Commission proposals to terminate special reduced mail rates for certain types of mailers could reduce budget authority and outlays needed for this purpose by $112.0 million. Taxpayers are unintentionally subsidizing political advocacy mail, prestigious professional trade organizations, and very profitable business seminar companies, and advertisers (travel agents, insurance companies, etc.), who "piggy back" onto reduced rate mail sent by universities and other nonprofit organizations. The House is urged to report a bill consistent with these proposals.

General Services Administration:

Federal Buildings Fund. The bill contains grants that are not authorized and that are not appropriate expenditures from the Federal Buildings Fund. These projects would cost $43.5 million and represent unnecessary expenditures in a time of budgetary constraint. The Administration urges the House to eliminate these grants and stop this totally inappropriate use of the Federal Buildings Fund.

General Management and Administration. The Committee reduces the President's request for the General Management and Administration (GM&A) account by $55.5 million and requires the General Services Administration revolving funds to reimburse GM&A for the costs. However, the Committee does not provide funds in the Federal Buildings Fund to pay for this reimbursement. The Administration urges the House to specify the source of funds in the Federal Buildings Fund for this reimbursement.

B. Language Provisions

Department of the Treasury:

Internal Revenue Service. The Administration objects to language which stipulates that the Internal Revenue Service (IRS) must fund enforcement activities related to United States subsidiaries of foreign-controlled corporations at a level not less than $10 million above fiscal year 1990 levels. This language represents excessive legislative direction of the management of an executive branch agency.

It also creates an unreasonable, if not impossible, program target for the IRS to meet. The total funding for the IRS international enforcement activity is $50 million for FY 1990. Mandating a $10 million increase for a program which is only a portion of this activity would require a drastic reallocation of resources. Furthermore, it may undermine any IRS efforts to improve enforcement related to United States subsidiaries of foreign-controlled corporations by forcing the program to grow at a rate faster than it can handle. Finally, it may have potentially adverse effects on overall tax compliance by inhibiting the ability of the IRS to develop a balanced tax enforcement strategy.

Employment Floors. The Committee bill mandates minimum employment floors for the Bureau of Alcohol, Tobacco and Firearms and the United States Customs Service. These agencies have not been able to meet legislatively-imposed FTE floors several times in recent years due to sequester, pay raise, and other unbudgeted cost absorptions and constraints on their ability to hire and train qualified personnel. The Administration objects to these mandated minimum employment levels-as FTE floors are difficult to implement and needlessly restrict an agency's ability to manage its resources.

Section 1151 of the Tax Reform Act. Section 524 of the Committee bill prohibits expenditures to enforce section 1151 of the Tax Reform Act of 1986. The Department of the Treasury has advised that section 1151 has been repealed.

Office of Personnel Management:

Executive Seminar Centers. Section 517 of the bill would prohibit the Office of Personnel Management (OPM) from closing or consolidating executive seminar centers. The Administration objects to this provision because it prevents OPM from exercising its managerial discretion over how best to use its training resources.

Blue Collar Employee Pay Raises. The Administration objects to section 612 of the Committee bill that would limit the pay raises of only certain blue collar workers to no more than that received by white collar government employees. As presently written, the provision does not contain this limitation on pay raises for blue collar workers whose wages are set through negotiation rather than by wage survey. The Administration urges the House to amend this provision to limit the pay increases,of all blue collar workers.

Restrictions on the Office of Management and Budget's (OMB) Review Authority. The Administration continues to be concerned about various restrictions on OMB's authority to study and review certain areas.

National Security Employee Non-Disclosure Agreements. The Administration strongly objects to section 617 of the bill, a provision that would restrict the President's ability to implement and enforce non-disclosure agreements, for the reasons stated by the President in signing the FY 1990 Treasury, Postal Service and General Government appropriations bill, which contained an identical provision.

Section 617 raises significant constitutional concerns insofar as it may be interpreted to intrude on the President's authority to control national security information in the Executive Branch. The President possesses the constitutional authority to require Federal employees who voluntarily assume positions of high trust, with access to the Nation's most sensitive secrets, to agree to keep those secrets. Such non-disclosure agreements are essential safeguards in protecting the national security.

The attached data tables can be downloaded in PDF format by clicking this link

Related PDFs

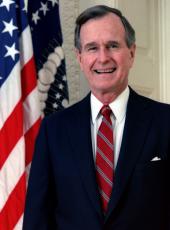

George Bush, Statement of Administration Policy: [H.R. 5241] - Department of the Treasury, Postal Service, and General Government Appropriations Bill, FY 1991 Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/329143