1. Foreign Direct Investment in the United States

The United States welcomes foreign direct investment. Foreign direct investment is beneficial to the U.S. economy. Like domestic investment, foreign investment creates jobs, promotes innovation, generates increases in productivity, and thereby raises U.S. living standards. It strengthens U.S. firms and makes them more competitive in the global economy.

The United States provides foreign investors fair, equitable, and nondiscriminatory treatment as a matter of both law and practice. While there are exceptions, generally related to national security, such exceptions are few; they limit foreign investment only in certain sectors, such as atomic energy, air and water transport, and telecommunications. These exceptions are consistent with our international obligations.

Consistent with this policy, the Exon-Florio Amendment to the Defense Production Act provides the President with authority to suspend or prohibit foreign mergers, acquisitions, and takeovers, where there is credible evidence of a threat to the national security.

2. U.S. Direct Investment Abroad

The United States believes that U.S. investment abroad should also receive fair, equitable, and nondiscriminatory treatment. The basic tenet of our policy is that U.S. investors should be accorded the better of national or most-favored-nation treatment. U.S. investors should receive the most favorable treatment offered by the host country to any investor, foreign or domestic, at the time of establishment and thereafter.

Accordingly, the United States continues to seek the reduction and elimination of practices by governments which restrict, distort, discriminate against, prohibit, or place unreasonable burdens on foreign direct investment.

Foreign direct investment can help ease the adjustment problems facing countries moving from centrally administered to market-oriented economies. For developing countries, particularly those that have embraced free market principles, foreign direct investment is vital to increase growth and reduce debt service burdens.

The adoption by all countries of open foreign direct investment policies would contribute significantly to improved worldwide economic health and would diminish distortions in an increasingly integrated world economy.

3. U.S. Initiatives

The United States has a number of initiatives underway to enhance the free flow of foreign direct investment in accordance with market forces.

-- In the Uruguay round, the United States is negotiating key multilateral agreements to eliminate trade-related investment measures; to protect trade-related intellectual property; and to promote trade in services, an area where many investment rules have prohibited highly competitive U.S. service industries from doing business abroad.

-- The United States, Canada, and Mexico are negotiating the North American free trade agreement, in which we are seeking to liberalize investment principles consistent with U.S. bilateral investment treaties.

-- In the Enterprise for the Americas Initiative, the United States and its partners are working with the Inter-American Development Bank to help nations of Latin America and the Caribbean to liberalize their investment regimes. To assist in carrying out these reforms, the United States has spearheaded the formation of a multilateral investment fund for Latin America and the Caribbean, which will be administered by the Inter-American Development Bank. Japan, Canada, Spain, Portugal, and several of the largest Latin American countries have agreed to join the United States in contributing to this fund. Others are actively considering joining.

-- The United States has signed bilateral investment treaties with 16 countries in Eastern Europe, Latin America, the Caribbean, Africa, and Asia and is negotiating such agreements with a number of other countries. These treaties represent important commitments to investment reform. They incorporate the principle of nondiscriminatory treatment; affirm international law standards for expropriation, including the principle of prompt, adequate, and effective compensation; provide for freedom of financial flows; and permit investors to take investment disputes to international arbitration.

-- The United States is also vigorously promoting the adequate and effective protection of intellectual property rights. Such protection is essential for the flow of investment into both developed and developing countries.

-- At the initiative of the United States, member countries of the Organization for Economic Cooperation and Development are studying ways to strengthen multilateral commitment to open, nondiscriminatory treatment of investment.

-- The United States will continue to encourage Japan to remove its investment barriers as an important goal of the Structural Impediments Initiative talks.

4. Conclusion

Throughout our Nation's history, foreign direct investment has played an important role in increasing economic growth and raising living standards. In order to meet the economic challenges of the 1990's, the United States will continue to implement its open, nondiscriminatory investment policy at home, and its policy of opening markets abroad.

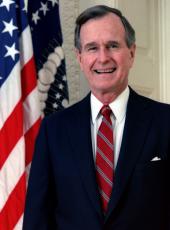

George Bush, White House Statement Announcing United States Foreign Direct Investment Policy Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/266258