Today I am signing into law H.R. 5334, the "Housing and Community Development Act of 1992." This bill establishes a sound regulatory structure for Government-sponsored enterprises (GSEs), combats money laundering, provides essential regulatory relief to financial institutions, authorizes several key Administration housing initiatives, and reduces the risk of lead-based paint poisoning.

This legislation addresses the problems created by the rapid expansion of certain GSEs in the last decade. It establishes a means to protect taxpayers from the possible risks posed by GSEs in housing finance. The bill creates a regulator within the Department of Housing and Urban Development (HUD) to ensure that the housing GSEs are adequately capitalized and operated safely.

H.R. 5334 includes many of my Administration's regulatory relief proposals for depository institutions. The regulatory burden that the Congress has placed on our banking system has reached a staggering level that prevents banks from providing the credit that is necessary to assure economic growth. By reducing the regulatory burden, this bill will assist banks, borrowers, and the economy as a whole.

This legislation also improves the Federal Government's ability to combat money laundering. It penalizes financial institutions convicted of money laundering and strengthens Federal law enforcement capabilities significantly. These provisions create important new tools in fighting the war against illegal drugs and other serious criminal activities.

The bill allows Federal prosecutors to obtain orders forfeiting tens of millions of dollars in assets belonging to drug kingpins that have been moved from the United States to foreign lands. It also authorizes the Government to prosecute those who launder the proceeds of corrupt foreign banks in the United States.

The anti money-laundering provisions of the bill include authority to seize funds belonging to foreign banks involved in criminal activities when those funds are located in interbank accounts in the United States. Interbank accounts, of course, are used to facilitate the transactions of innocent third parties. Because of the potential impact on such transactions, it is important that this seizure authority be used judiciously and with attention to the effect such seizures might have on the interbank payment and clearing system. The Attorney General and the Secretary of the Treasury will work together to ensure coordinated review of such cases.

This legislation also advances the Federal Government's efforts to eliminate lead-based paint hazards, especially among those most vulnerable -- young children. The bill would focus inspection and hazard reduction efforts by HUD on older housing stock where the incidence of lead paint is greatest. It also supports the development of State programs to certify contractors who engage in lead-based paint activities.

I regret, however, that the Congress chose to attach these important reforms to a housing bill that contains numerous provisions that raise serious concerns. My Administration worked diligently to craft a compromise housing bill that would target assistance where it is needed most, expand homeownership opportunities, ensure fiscal integrity, and empower recipients of Federal housing assistance.

I also note that two provisions of the bill must be narrowly construed to avoid constitutional difficulties. Section 1313 would authorize the Director of the newly established Office of Federal Housing Enterprise Oversight within HUD to submit "reports, recommendations, testimony, or comments" to the Congress without prior approval or review by "any officer or agency of the United States." The bill also provides the Director authority, exclusive of the Secretary of Housing and Urban Development, to promulgate safety and soundness regulations and to formulate an annual budget. When a member of the executive branch acts in an official capacity, the Constitution requires that I have the ultimate authority to supervise that officer in the exercise of his or her duties. In order to avoid constitutional difficulties, and without recognizing the Congress' authority to prevent the Secretary from supervising on my behalf an agency within HUD, I will interpret this provision to permit me to supervise the Director through other means, such as through the Office of Management and Budget.

Section 911 of the bill requires the Secretary of Housing and Urban Development to establish guidelines for housing credit agencies to "implement" section 102(d) of the Department of Housing and Urban Development Reform Act of 1989 (42 U.S.C. 3545(d)). That provision requires the Secretary to certify that HUD assistance to housing projects is not more than necessary to provide affordable housing, after taking other Federal and State assistance into account, and to adjust the amount of HUD assistance to compensate for changes in assistance amounts from other sources. To avoid the constitutional difficulties that would arise if section 911 were understood to vest in housing credit agencies the exercise of significant authority under Federal law, I interpret section 911 to permit the Secretary to formulate guidelines under which he will retain the ultimate authority to make the determinations required by section 102(d).

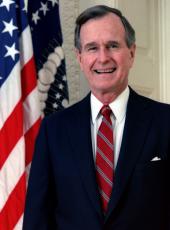

George Bush

The White House,

October 28, 1992.

Note: H.R. 5334, approved October 28, was assigned Public Law No. 102 - 550. This statement was released by the Office of the Press Secretary on October 29.

George Bush, Statement on Signing the Housing and Community Development Act of 1992 Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/267445