Statement of Administration Policy: S. 774 - Financial Institutions Reform, Recovery, and Enforcement Act of 1989

(Senate)

(Riegle (D) Michigan)

The Administration strongly supports Senate passage of S. 774 and urges Congress to continue to act quickly to send to the President legislation that will resolve the current crisis and ensure that it is never repeated.

The Administration continues to believe that having sufficient private capital at risk, ahead of the deposit insurance fund, is an essential safeguard for American taxpayers and is needed to prevent future losses. More than any other factor, the massive losses incurred by thrifts — which this legislation funds — were a result of growth without the discipline of prudent levels of capital that exist for national banks.

Accordingly, the Administration will work in conference and in the House of Representatives to strengthen the capital requirements in the final legislation. If the capital requirements in the bill presented to the President are not sufficiently strong, or if the Administration's financing mechanism is brought on-budget or altered in violation of the recent budget accord, the President's senior advisers would recommend a veto of the legislation.

The Administration also has other concerns about several specific provisions of the bill and will work to ensure that they are resolved. The Administration's other major concerns are outlined below.

- Budget and legislative bypass for Office of Savings Associations (OSA) and Office of the Comptroller of the Currency (OCC). The requirement of this bill that OSA and OCC submit legislative recommendations directly to Congress, without review within the Executive branch, would violate Article II of the Constitution, which confers upon the President sole authority to "recommend" to Congress "Consideration [of] such Measures as he shall judge necessary and expedient." Moreover, the requirement of S. 774 that OSA and OCC concurrently transmit budget estimates to Congress and OMB interferes with presidential review of such estimates and is similarly troublesome.

- Service of FDIC Chairman. The bill should make explicit that the FDIC Chairman serves as Chairman at the pleasure of the President, as provided in the Administration's bill. The Administration's approach ensures that Executive branch officials are accountable to the President and would contribute to the accountability of such officials to the public.

- Quarterly reporting by the FDIC. The bill should be amended to provide that such reports be made both to Treasury and OMB, in order to ensure prudent and timely financial planning within the Executive branch.

- Independent litigating authority for OSA. Provisions of this nature are a serious erosion of the general reservation of litigation authority to the Attorney General contained in 28 U.S.C. 612 and prevent the Attorney General from directing and conducting all litigation on behalf of the United States Government.

- Compensation of employees of the OCC. A provision of S. 774 that would permit the Comptroller of the Currency to fix the compensation of OCC employees without regard to any other laws or regulations should be amended to make any such determination subject to the approval of the Secretary of the Treasury, consistent with both the Administration's proposal and the bill's treatment of compensation of employees of the OSA.

- Limitation on FDIC notes and obligations. S. 774 would cap the amount of notes and obligations that the FDIC would be permitted to issue at 100 percent of the assets of the deposit insurance funds. This is not a meaningful limitation, because total fund assets are increased by the value of the assets acquired when the FDIC issues notes. The Administration believes that a cap limiting new notes and obligations to no more than 75 percent of the net worth of the deposit insurance funds would be much more prudent and sound.

- Procedures applicable to claims brought by the FDIC. S. 774 would give a priority to the FDIC's claims against directors, officers, employees, agents, attorneys, and others employed by financial institutions in any suit, claim, or cause of action brought by the FDIC, "except for claims of Federal agencies as provided in section 6321 of the Internal Revenue Code of 1986 and section 3713 of title 31, United States Code." Such a provision conflicts with the the legitimate conflicting claims of other Federal agencies that are not covered by the Federal Priority Statute.

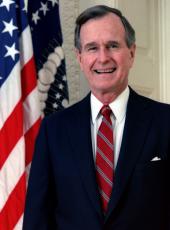

George Bush, Statement of Administration Policy: S. 774 - Financial Institutions Reform, Recovery, and Enforcement Act of 1989 Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/328093