(House Floor)

This Statement addresses certain tax measures to be considered by the House on August 3. If any of these bill are presented to the President without acceptable pay-as-you-go offsets (either in the bill or from available balances of acceptable pay-as-you-go offsets), his senior advisors will recommend a veto.

H.R. 5642 - Tax Treatment of Certain Farm Credit Associations and Alternative Minimum Tax (AMT) Treatment for Certain Insurance Companies

(Jacobs (D) Indiana)

The Administration opposes H.R. 5642 on policy grounds and because it increases the deficit. The Administration opposes the provision related to mergers of farm credit associations because it creates burdensome administrative problems.

The Administration opposes the provision exempting underwriting income of small property and casualty insurance companies from the AMT because there is no justification for such an exception.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -10 | -26 | 57 | -8 | -9 | -10 | -6 |

H.R. 5660 - To Exempt from the Unrelated Business Income Tax (UBIT) the Conduct of Certain Games of Chance bv Tax-Exempt Organizations

(Hoyer (D) Maryland and McGrath (R) New York)

The Administration opposes H.R. 5660 if an unacceptable offset is used to meet the pay-as-you-go requirement of the Omnibus Budget Reconciliation Act (OBRA). The Administration also believes that an exemption should be applicable only if the wagering is conducted by volunteers.

Revenue estimates are still being prepared for H.R. 5660.

H.R. 5674 - Taxation of Intermodal Cargo Containers

(Vander Jagt (R) Michigan)

The Administration opposes H.R. 5674 on policy grounds and because it does not meet the pay-as-you-go requirements of OBRA. The Administration opposes the provision related to intermodal cargo containers because (1) it provides purely retroactive relief to taxpayers who failed to maintain adequate records substantiating their return positions and (2) the IRS has promulgated reasonable settlement guidelines based on industrywide data.

The Administration opposes the provision related to small property and casualty companies because there is no justification for providing such companies a special tax deduction.

The Administration also opposes the "pay-for", the elimination of the stock-for-debt exception, because 1) it is necessary to address cancellation of indebtedness income in a comprehensive manner, and 2) the provision creates a bias against the use of equity in workouts of insolvent and bankrupt companies.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -52 | 6 | 35 | 64 | 86 | 139 |

H.R. 5650 - Non-Exempt Farmer Cooperatives and Limited Equity Housing Cooperatives

(Dorgan (D) North Dakota)

The Administration opposes H.R. 5650 on policy grounds. The Administration opposes the farm cooperatives provision because (1) it is not restricted to farm cooperatives; (2) it provides an inappropriate and unnecessary change in the character of gains and losses from capital to ordinary; and (3) it allows cooperatives flexibility in a manner which is inconsistent with the stated policy underlying the provision. The Administration would not be opposed to this provision if it were modified to address these objections.

The Administration opposes the provision related to housing cooperatives because (1) it allows members of such cooperatives to offset investment income with personal housing-related expenses, an opportunity not available to any other individual homeowners or tenants and (2) it is not limited to low income cooperatives.

The Administration also opposes the "pay-for", an expansion of the high yield discount bond rules, because (1) these rules are complex and difficult to administer and (2) the rules are inconsistent with general tax principles relating to the classification of securities as debt or equity.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | 6 | 11 | 14 | -10 | -15 | 6 |

H.R. 5654 - Application of Harbor Maintenance Tax to Movement of Certain Cargo Containers

(Levin (D) Michigan)

The Administration opposes the "pay-for" included in H.R. 5654 because it would increase the harbor maintenance tax for the entire industry.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -- | -- | -- | -- | 1 | 1 |

H.R. 5641 - Tax Treatment of-Certain Nonprofit Organizations Providing Health Benefits

(McGrath (R) New York)

The Administration opposes this bill on policy grounds and because it does not satisfy the pay-as-you-go requirements of OBRA. The Administration opposes the provision related to extending the special tax treatment of Blue Cross, Blue Shield and similar organizations to other taxpayers that do not fulfill the requirements of section 833 of the Code, unless certain modifications are made to limit its applicability.

The Administration opposes the provision relating to shares purchased by a certain employee stock ownership plan because it gives retroactive relief to a single taxpayer.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -16 | -5 | -- | 3 | 9 | -9 |

H.R. 5659 - St. Paul Port Authority Bonds

(Pease (D) Ohio)

The Administration opposes H.R. 5659 because it does not satisfy the pay-as-you-go requirements of OBRA and because there is no justification for providing unique treatment for one jurisdiction's debt.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -1 | -1 | -1 | -1 | -1 | -5 |

H.R. 5648 - Wagering Taxes on Charitable Organizations

(Russo (D) Illinois)

The Administration does not oppose this bill if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -1 | -1 | -1 | -1 | -1 | -5 |

H.R. 5644 - Excise Taxes on Private Foundations that Remove Hazardous Substances

(Bunning (R) Kentucky)

The Administration does not oppose this bill if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -1 | -1 | -1 | -1 | -1 | -5 |

| * less than $500,000 | |||||||

H.R. 5661 - Exempting Certain Ferry Transportation From Excise Tax

(Andrews (D) Texas)

The Administration does not oppose enactment of H.R. 5661 if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -1 | -1 | -1 | -1 | -1 | -5 |

H.R. 5649 - Repeal Occupational Taxes on Liquor Industry

(Matsui (D) California)

The Administration opposes H.R. 5649 on policy grounds and because it does not satisfy the pay-as-you-go requirements of OBRA. The Administration opposes the "pay-for", a diesel fuel tax modification, because there is substantial uncertainty regarding the resulting administrative and compliance costs. The Administration also opposes the use of trust fund revenues for general revenue purposes.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | 63 | -85 | -94 | -95 | -96 | -307 |

H.R. 5643 - Tax Treatment of Licensed Cotton Warehouses

(Ford (D) Tennessee)

The Administration has no objection to H.R. 5643 if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -6 | -- | -- | -- | -- | -6 |

H.R. 5658 - Tax Treatment of Alaska Native Corporations

(McDermott (D) Washington)

The Administration does not oppose H.R. 5658 if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -28 | -6 | -6 | -6 | -7 | -53 |

H.R. 5655 - Restoring Prior-Law Treatment of Corporate Reorganizations

(Moody (D) Wisconsin)

The Administration opposes H.R. 5655 because it is not a comprehensive solution to cancellation of indebtedness income issues and because it allows taxpayers inappropriate flexibility in the timing of income recognition. The Administration also opposes the bill because it does not meet the pay-as-you-go requirements of OBRA.

The Administration opposes the "pay-for", an increase in the mileage requirement for the deduction of moving expenses, because it increases the tax burden on a class of taxpayers receiving no benefits from the bill.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -87 | -20 | -- | 34 | 70 | -3 |

H.R. 5652 - Extending Rollover Period for Principal Residences for Taxpayers with Frozen Assets in Financial Institutions

(Donnelly (D) Massachusetts)

The Administration has no objection to enactment of H.R. 5652 if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -2 | -2 | -3 | -3 | -3 | -13 |

H.R. 5647 - Special Estate Tax Valuation Recapture Rules

(Grandy (R) Iowa)

The Administration has no objection to enactment of H.R. 5647 if it is modified to satisfy the pay-as-you-go requirements of OBRA.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -5 | -5 | -5 | -5 | -- | -20 |

H.R. 5656 - Social Security and Summer Camp Counselors

(Moody (D) Wisconsin)

The Administration opposes H.R. 5656 because it does not satisfy the pay-as-you-go requirements of OBRA and because there is no justification for distinguishing these employees from other part- time or temporary employees.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -1 | -1 | -1 | -2 | -2 | -7 |

H.R. 5657 - Tax Treatment of Deposits Under Perpetual Insurance Policies

(Cardin (D) Maryland)

The Administration opposes H.R. 5657 because it does not satisfy the pay-as-you-go requirements of OBRA and because there is no justification for the creation of a significantly tax-advantaged vehicle for payment of property and casualty insurance.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Receipts | -- | -- | -5 | -36 | -37 | -38 | -116 |

H.R. 5675 - Statutory Bond Extensions

(Anthony (D) Arkansas)

The Administration supports enactment of H.R. 5675.

H.R. 5675 has a negligible revenue effect.

Pay-As-You-Go Scoring

The bills addressed in this Statement affect receipts; therefore they are subject to the pay-as-you-go requirement of OBRA. The Table below includes the estimated total effect of all of these bills. A budget point of order applies in both the House and Senate against any bill that is not fully offset under CBO scoring. If, contrary to the Administration's recommendation, any such point of order that applies against one of these bills is waived, the effects of enactment of these bills will be included in a look-back pay-as-you-go sequester report at the end of the congressional session.

Treasury's preliminary scoring estimates of these bills is presented below. Final scoring of them may deviate from these estimates. If any of these bills is enacted, final OMB scoring estimates would be published within five days of enactment, as required by OBRA. The cumulative effects of all enacted legislation on direct spending will be issued in monthly reports transmitted to the Congress.

Estimates For Pay-As-You-Go

($ in millions)

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1992-1997 | |

| Net Deficit Increase (+) or Decrease (-) |

+10 | +157 | +58 | +107 | +69 | +8 | +410 |

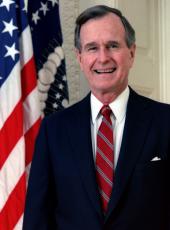

George Bush, Statement of Administration Policy: Miscellaneous Tax Measures Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/330414